Personal Financing

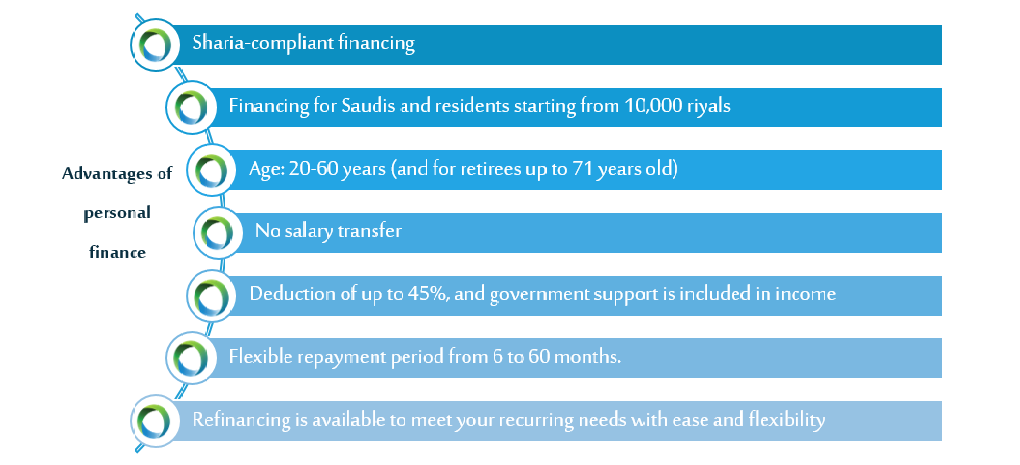

Al-Nayifat Finance Company offers Sharia-compliant personal financing solutions for Saudis and residents, with flexible and fast procedures and the ability to refinance when needed.

Individual financing

| Income | Disburse Amount | FEES + VAT | FEES 1% | Annual Percentage Rate (APR) | Intallment Amount | TENURE |

|---|---|---|---|---|---|---|

| 4,500 | 10,000 | 115 | 100 | 36.42% | 566.67 | 24 |

| 7,656 | 89,400 | 1028.1 | 894 | 32.13% | 2,793.75 | 60 |

| 14,117 | 38,000 | 437 | 380 | 33.06% | 1,204 | 60 |

| 21,480 | 15,000 | 172.5 | 150 | 30.08% | 454.38 | 60 |

| 25,444 | 150,000 | 1,725 | 1,500 | 29.80% | 4,524 | 60 |

| 1,985 | 35,200 | 404.8 | 352 | 14.99% | 819.87 | 60 |

| 1,985 | 10,500 | 120.75 | 105 | 15.56 | 820 | 14 |

| 1,985 | 10,000 | 115 | 100 | 14.99% | 232.92 | 60 |

Note: The figures shown are preliminary calculations and are not considered a commitment or an offer made by the company